Asset

"Asset" in financial community = "token" in non-financial community.

There is a separate Token article that concentrates on the four kinds of tokens on the Byteball platform with zero or tiny monetary value, rather than those used more financially.

From the white paper:

Users can issue new assets and define rules that govern their transferability. The rules can include spending restrictions such as a requirement for each transfer to be cosigned by the issuer of the asset, which is one way for financial institutions to comply with existing regulations. Users can also issue assets whose transfers are not published to the database, and therefore not visible to third parties. Instead,the information about the transfer is exchanged privately between users, and only a hash of the transaction and a spend proof (to prevent double-spends) are published to the database.[1]

Contents

- 1 Byteball Asset Manager

- 2 Fractional ownership

- 3 ICO bot

- 4 The ICO craze

- 5 Regulation

- 6 Bitcointalk copypasta

- 7 External links

- 8 References

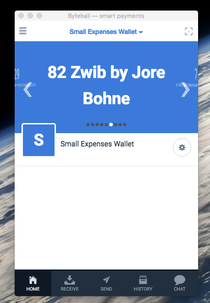

Byteball Asset Manager

Here you can create your own token/asset. You must also register[2] it before the name (instead of the hash) will display in a wallet.

- Example name: Zwib by Jore Bohne

- Example hash: ZWlbZhl6C9IsV3biDC+ngzsLq58mQ0hbwWyLBLpFLQc=

Why are you creating a token?

It is important to work out the purpose of a token before you start to create it. There can be both frivolous/trivial reasons -- where it is probably better not to create the token after all -- and serious ones where you go ahead.

Trivial reasons

- I want to see if it works: It does work. Really.

- I want to have coins in my wallet in addition to bytes and blackbytes: Download some free fun-coins from the free faucet in your wallet Bot Store.

- I want to see my name in the wallet: You can, but first you need to verify your identity with a Registry, and then register the token.

Serious reasons

- As part of a well-conceived business plan: But think it through. People with zero experience using a crypto wallet are not likely to embrace the idea of exchanging Byteball tokens in *any* business setting. Maybe in a few years from now, but not currently.

- Family tokens, social tokens: See the tokens page for details.

The fields in the application form

Cap (money supply): Defaults to 1000, but can be between 1 and 10^15. You can only create a token with this unique hash once, so think carefully how many you need.

Auto-destroy: If you check this box, it means that any new asset/token sent to its defining address become unspendable, like sending something to a black hole.

Add asset details to asset directory: Look at an asset directory exampleCite error: Closing </ref> missing for <ref> tag and a similar bot.

Registration policy.[3] A recent registration record.[4]

Once a name is registered, it becomes visible in the wallets updated to a recent version (2.0+).

Contact Peter to assign human readable names to your assets.

Other attributes

Some of the attributes don't make sense to set differently to the default if a 3rd party is used for asset creation.

- If "Issued by definer only" was false that would mean anyone could issue new assets, but then how much would the original requestor get? And who would be the issuer?

- If "Co-signed by definer" was true, Byteball market would have to sign all transactions of that asset.

- "Spender attested" could be true, but that would require listing all accepted attestors. Currently the byteball.market owner doesn't know anyone doing attestation on the Byteball platform, so he didn't find it important to support yet.

New assets

- Clicking the link will take you to the unit page, where you can see how the asset/token is defined. Some examples:

| Asset | Contact | Notes |

|---|---|---|

| Zwibs [5] | @slackjore | first new asset on platform |

| CK1[6] | @cryptkeeper | community asset with membership-like features like special discounts at webshops |

| Scamcups[7] | @chainsaw | first asset with great random name in hash (LScaMCup...) |

Titan Coin

See Wiki article Chatbot Section TitanCoin ICO for details

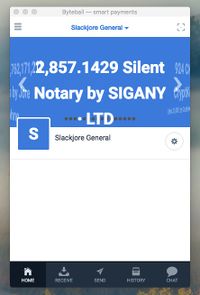

SilentNotary by Sigany Ltd

See Wiki article Chatbot Section SilentNotary ICO for details

Just do it

You can simply send your new (unrestricted) assets/tokens to any Byteball address, with no chat or contract needed. Copy the address, open the send tab, find the asset/token in your drop-down box, paste the address, enter the amount (in whole numbers), and click Send. Perfect for confusing people who aren't expecting to receive 25 Zingos in their wallet!

Caution: Be careful to send the right asset/token. Don't send someone 4 GB by mistake when you mean to send 4 Zingos. Not joking. Double-check.

Textcoin

With wallet version 2.1, you can send any public asset -- including your newly-created one -- by textcoin.

Transaction fees

Usual transaction fees apply. So sending 9 Zingos somewhere will cost 750 bytes, or whatever. At 1GB = $750, 1MB = $0.75, 1KB = $0.00075, and 750 bytes = $0.0005 so you won't go broke.

Change address

See the wiki change address article if you're not sure how these work and apply here.

New assets/tokens in your wallet

You started off with 0 bytes in your wallet. Later, you probably got some bytes, and maybe some blackbytes. At present, maybe some Zwibs and/or something else. If you click the Send tab, you'll see you a drop-down menu, and you can spend from any of your asset types.

Note that these listed asset/token types remain, even if the balance of one particular asset/token is zero. So every time someone receives some Zingos, the Zingo asset/token type gets added to their wallet asset/token list, indelibly so for now. After a few of these, if you don't really want them, they act as spam.

So, please don't send your new assets/tokens to someone without asking them first if they want them. :)

Directory

There is an asset/token directory[8] where you can view details of the new assets/tokens.

Fractional ownership

Fractional ownership is a method in which several unrelated parties can share in, and mitigate the risk of, ownership of a high-value tangible asset, usually a jet, yacht or piece of resort real estate. It can be done for strictly monetary reasons, but typically there is some amount of personal access involved. One of the main motivators for a fractional purchase is the ability to share the costs of maintaining an asset that will not be used full-time by one owner. Every fractional endeavour requires some sort of management, to administer the rules and regulations (which are agreed upon before the fraction is purchased) and maintain the asset to the degree laid out in the ownership documents.[9]

Tokenization

Tokenization is the process of converting fractional-ownership rights to an asset into a digital token on a distributed ledger. There is great interest by financial intermediaries and technologists around the world in figuring out how to move real-world assets onto blockchains to gain the advantages of cryptocurrencies while keeping the characteristics of the asset.[10]

Byteball tokens

Could the Byteball platform be utilised in various fractional-ownership schemes? Possibly. But management, asset security and maintenance etc, complicate the picture. It would not be as straightforward as the uses seen so far.

ICO bot

TitanCoin is the first use of our ICO bot which was published on github just recently.[11] The bot is designed to help entrepreneurs raise funds and distribute their tokens, easily and securely. The current version (2018-01-07) now accepts BTC and ETH in addition to Bytes. The tokens are issued immediately after the payment is confirmed.

Identity verification for ICOs

Identity verification is now (after 18 January 2018) possible in your Byteball wallet, where you can selectively reveal some or all of name, date of birth, country, ID number, ID type to a coin issuer. The general process links a real-world identity to a specific single-address wallet, so you can still be anonymous to the coin-issuer but the coin-issuer can be confident that your real-world identity is attested. This has important KYC implications.

The ICO craze

This must-watch 9-minute video from Andreas Antonopoulos explains how ICOs will disrupt financial technology all across the spectrum; how almost all ICOs currently are bad; how regulators will try but won't be able to keep with new innovations and their rules will be unenforceable anyway; how society has to wade through hundreds of losing imvestments in order to finally learn what is a good ICO investment.

Regulation

Be aware that fundraising via new assets/tokens on cryptocurrency platforms, sometimes issued as ICOs (Initial Coin Offerings), are increasingly being regulated in various nations. For a general overview of this by country, see here[12].

SEC

On July 25, 2017, the US SEC (Securities and Exchange Commission) issued a report[13] stating that offers and sales of digital assets by "virtual" organizations are subject to the requirements of the federal securities laws. The key points from this are that:

- Digital assets can be securities

- That determination will depend on the facts and circumstances of each case (see Howey)

- Digital assets that are deemed securities are subject to U.S. securities laws.

The third point is extremely broad because securities laws are very extensive.

Howey Test

Excerpted from Findlaw.com "What is the Howey Test?[14]:

Whether a particular investment transaction involves the offer or sale of a security – regardless of the terminology or technology used – will depend on the facts and circumstances, including the economic realities of the transaction.

Under the Howey Test, a transaction is an investment contract (and thus subject to securities registration requirements) if:

- It is an investment of money

- There is an expectation of profits from the investment

- The investment of money is in a common enterprise

- Any profit comes from the efforts of a promoter or third party

Refer to the linked article for further explanation of these four points. It might be a good idea to not use the word "investment" in describing your asset/token.

Jurisdiction

Does this apply to your token/asset? Depends. The US lately has been assuming a "World Police" function, whether sanctioned by international law or not. If in doubt, consult a competent lawyer.

China

On September 4, 2017, the People's Bank of China declared all ICOs (Initial Coin Offerings) illegal.[15] A report from September 10 said this may be "only temporary, until local financial regulators introduce necessary regulatory frameworks and policies for both ICO investors and projects."[16] How this applies to any new asset issued on the Byteball platform is not clear.

Bitcointalk copypasta

Source[17]

5/29 from tonych: Developer guide for issuing new assets on Byteball: https://github.com/byteball/byteballcore/wiki/Issuing-assets-on-Byteball

5/30 response: It's the same purpose as ethereum tokens, except the feature is built natively in Byteball and you don't need to write a smart-contract to manage the assets you emitted.

5/30 from tonych (post #8739): [Examples] ICOs, shares, bonds, fiat-pegged coins, loyalty points, minutes of airtime, assets in online games, whatever you can imagine. [How traded and where] They can be immediately traded P2P via smart contracts (same as blackbytes).

External links

- https://byteball.market Byteball Asset Market

- https://titan-coin.com/?lang=en TitanCoin website

- https://steemit.com/byteball/@byteball.market/byteball-asset-registration-and-issuance-under-the-hood

References

- ↑ https://byteball.org/Byteball.pdf abstract

- ↑ https://docs.google.com/document/d/e/2PACX-1vQnpiwTipnBgrhSJcELOYYAOa3mTLZbmLmOebbtHFJFrfgHtlsNNZ9MPEGafvtuTnVAyfWukwu_hYSB/pub

- ↑ https://docs.google.com/document/d/e/2PACX-1vQnpiwTipnBgrhSJcELOYYAOa3mTLZbmLmOebbtHFJFrfgHtlsNNZ9MPEGafvtuTnVAyfWukwu_hYSB/pub

- ↑ https://explorer.byteball.org/#IYeNVOvVeP8X9hDx3LgPu48MCTVbeo8S/NJM0vIAY14=

- ↑ https://explorer.byteball.org/#ZWlbZhl6C9IsV3biDC+ngzsLq58mQ0hbwWyLBLpFLQc=

- ↑ https://explorer.byteball.org/#3kc7H8A2oiWr9mv7AcWJeLCA0Cp8c3BLK04kYQ+5pfU=

- ↑ https://explorer.byteball.org/#LScaMCupXYOxp7hJpo6XfHqyAdHVtcvpU9uaLrAV+oI=

- ↑ https://byteball.market/#!/assets

- ↑ https://en.wikipedia.org/wiki/Fractional_ownership

- ↑ https://www.nasdaq.com/article/how-tokenization-is-putting-real-world-assets-on-blockchains-cm767952

- ↑ https://github.com/byteball/ico-bot

- ↑ https://en.wikipedia.org/wiki/Initial_coin_offering#Regulation

- ↑ https://www.sec.gov/news/press-release/2017-131

- ↑ http://consumer.findlaw.com/securities-law/what-is-the-howey-test.html

- ↑ http://www.pbc.gov.cn/goutongjiaoliu/113456/113469/3374222/index.html

- ↑ https://www.cointelegraph.com/news/china-ban-on-ico-is-temporary-licensing-to-be-introduced-official

- ↑ https://bitcointalk.org/index.php?topic=1608859.0